- Developed and deployed predictive analytics models to reduce false-positive fraud alerts by 20%.

- Automated customer payment behavior scoring using CRM-integrated credit evaluations.

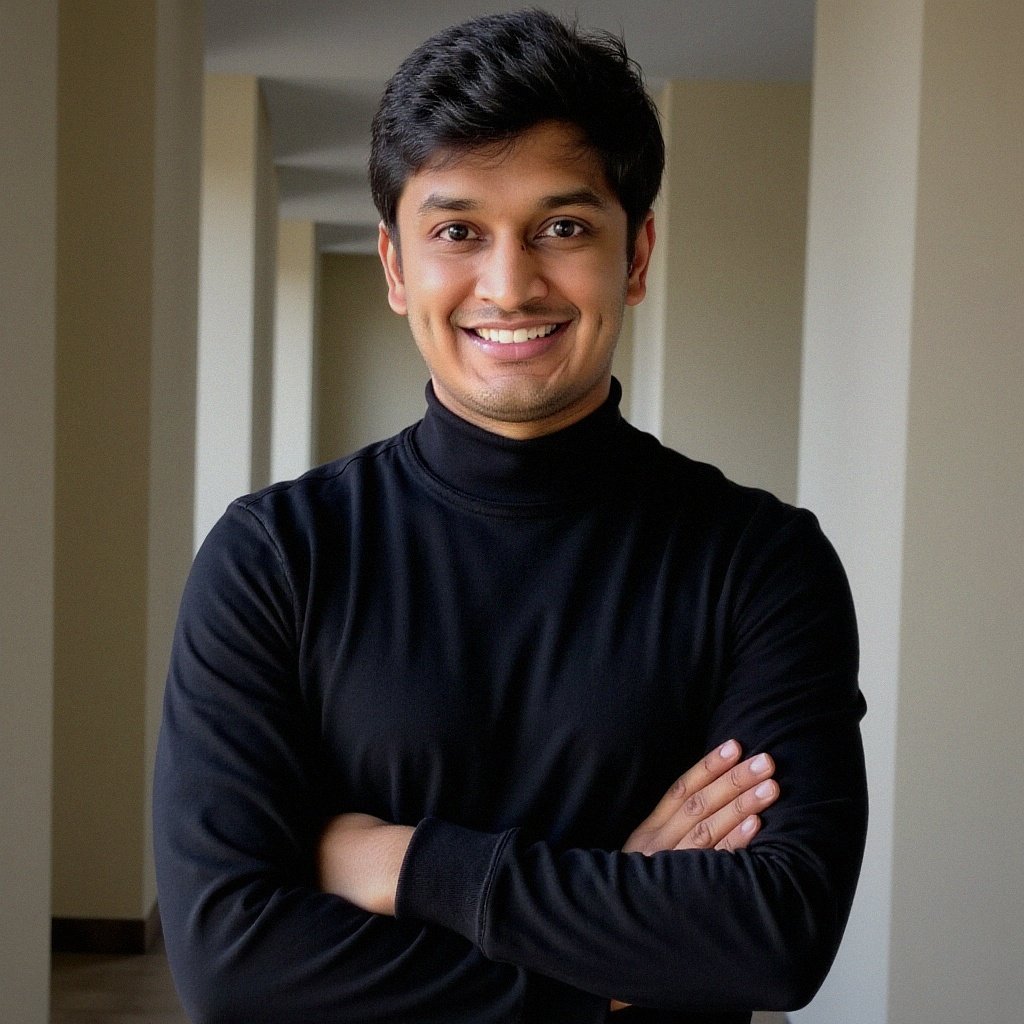

Hello.

I'm a

Credit

Risk Analyst

Strategic Credit Risk Analyst with expertise in financial data interpretation, risk control frameworks, and credit policy implementation. Experienced in leveraging analytics, regulatory compliance, and dashboard tools to assess creditworthiness, minimize exposure, and drive smarter financial decisions across banking and fintech environments.

Services

Services I Offer

Credit Risk Assessment & Forecasting

Evaluating financial statements and borrower profiles to assess risk exposure, implement mitigation strategies, and forecast defaults using data-driven models.

Regulatory Compliance & Risk Control

Ensuring adherence to Basel III and internal risk frameworks, conducting audits, and reducing regulatory breaches across high-risk accounts.

Credit Policy Design & Implementation

Developing and enforcing credit evaluation policies to streamline decision-making and minimize bad debt ratios across portfolios.

Financial Data Analysis & Reporting

Performing variance analysis, building dashboards, and delivering actionable financial insights using tools like Power BI and Tableau.

Fraud Detection & Risk Intelligence

Deploying predictive models and transaction monitoring systems to enhance fraud detection and reduce false positives.

Cross-Functional Collaboration & Project Leadership

Leading teams across finance, credit, and operations to streamline credit workflows, minimize delays, and enhance service delivery.

Experience

Skills and

Experience

Expert in credit risk evaluation, fraud detection, financial analysis, regulatory compliance, and data-driven decision-making—driving safer lending, strategic forecasting, and operational efficiency across banking and fintech sectors.

My Skills

Credit Risk Assessment & Forecasting

Financial Statement Analysis

Fraud Detection & Risk Intelligence

Regulatory Compliance & Audit Management

Credit Policy & Risk Control Frameworks

Data Visualization (Power BI, Tableau)

Experience

-

Feb 2023 – Apr 2023

Fraud Specialist II

JP Morgan Chase & Co., India -

Jun 2020 – Jan 2023

Executive – Financial Services

Whitehat Education Technology Pvt Ltd, India -

Feb 2020 – May 2020

Deputy Manager – Credit Risk

IndusInd Bank, India -

May 2018 – Sep 2019

Risk Manager

Bajaj Finance Ltd, India

Portfolio

Latest Projects

CreditIntel

RiskMatrix

- Implemented compliance protocols that cut regulatory breaches by 15%.

- Conducted high-risk merchant audits and enforced operational risk controls.

FinDash

- Created visual dashboards using Power BI to track portfolio performance and detect anomalies.

- Streamlined reporting workflows, reducing manual error rates by 30% and improving audit accuracy.

Testimonial

Client's Kind Word

"Vaibhav's financial insights transformed how we assess client risk. His data-driven models and detailed credit evaluations helped us cut down bad debt and increase portfolio health significantly."

Ritu Verma

Credit Director, IndusInd Bank"We saw a 20% reduction in fraud alerts thanks to Vaibhav’s predictive modeling skills. His hands-on work with our risk team elevated operational efficiency."

Arjun Mehta

VP – Fraud Analytics, JP Morgan Chase"Vaibhav brought clarity to our compliance processes and implemented dashboards that made executive decision-making faster and smarter."

Neha Sharma

Risk & Compliance Head, Bajaj Finance"From automation to financial analysis, Vaibhav played a critical role in improving client onboarding and investment advisory efficiency. His structured approach is truly commendable."

Siddharth Rao

Senior Operations Manager, Whitehat Jr.Contact

Let's Discuss Project

Get in touch

Our friendly team would love to hear from you.

-

Phone

+1 519-778-3070

-

Mail

kalantrivaibhav03@gmail.com

-

Visit My Office

Ontario, Canada